However, we’re headed for recession and more insolvency appointments.

Another quarter has flown by and it’s time to take another look at how insolvency appointment numbers are tracking and look into our crystal ball to see what the future might hold.

The current picture

First, let’s look at where insolvency appointments are at the moment.

Corporate insolvency

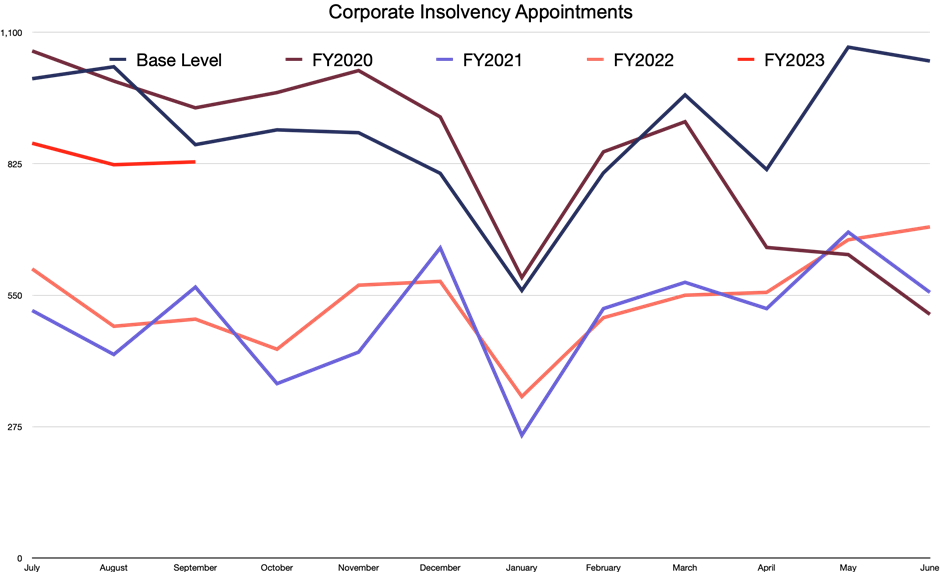

Corporate insolvency appointments are up.

In the first quarter of FY2023 appointments were up 60% on the same period last year and were much closer to historical levels than they have been over the last two years, with appointments averaging 840 per-month over the last three months.

Of particular note is the growing popularity of small business restructuring (SBR). So far this year, we have had 83 SBR appointments, more than we had in the first eighteen months following the introduction of SBRs.

Personal insolvency

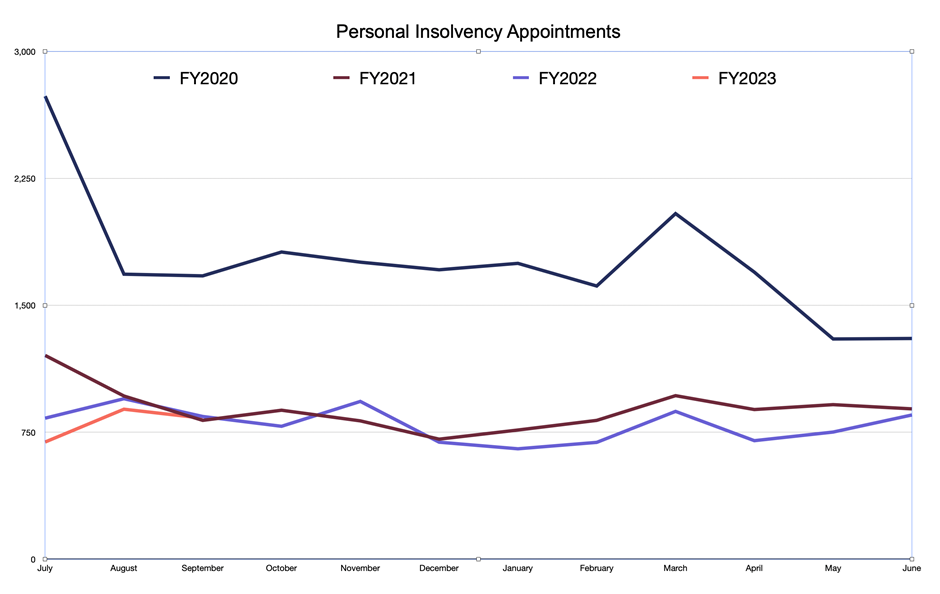

Personal insolvency appointments remain low.

In stark contrast to corporate insolvency appointments, personal insolvency appointments this financial year are lower than ever. This continues the depressed appointment numbers we have had over the last two years.

A strong economy

So, what’s going on? Why—Despite all the years of lockdowns, talk of zombie companies and business stress, and muted economic difficulties—has the number of insolvency appointments remained well below historical trends?

The main reason is, despite some headwinds, Australia’s economy is doing well and as long as this continues, insolvency appointments are likely to stay below the trend.

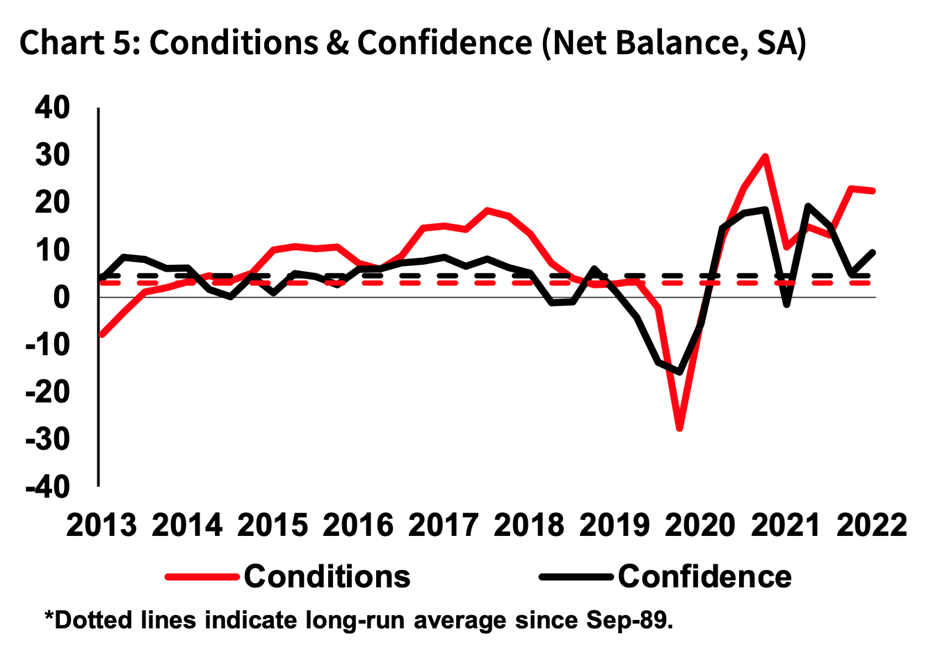

Business conditions remain strong

Business conditions, as measured by the NAB Quarterly Business Survey[iii] remain well above average. While businesses are facing some headwinds, in particular difficulties with staffing, the availability and cost of some supplies, and rising interest rates, trading conditions are good, which is keeping businesses from failing.

Consumer spending

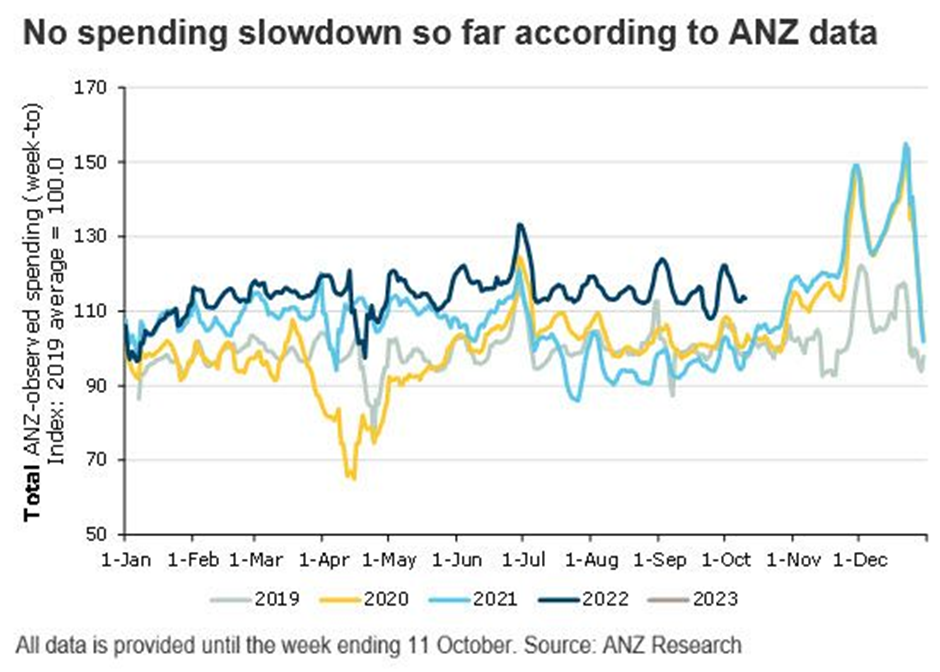

Consumer spending

Further to generally good business conditions, household spending remains very strong and well ahead of trend. Consumer spending has been elevated for all of 2022 so far, as low unemployment and strong household balance sheets have allowed people to get out and spend money at record rates.

I expect this trend to continue well into 2023. Australian households still have a huge war chest of excess savings (about $294 billion) , built up over the pandemic period, to deploy before they will be forced to tighten their belts.

Downside risks

Unfortunately, it’s not all good news. While the economy is doing well currently, businesses and households will face significant challenges over the longer run that will lead to an increase in insolvency appointments over the next two years.

ATO debt collection

The Australian Taxation Office (ATO) restarted its debt collection processes, after a long hiatus during the pandemic period. As at December 2021, the ATO's debt book was $61.4B, up 16% from the year before; and the ATO will need to work through and collect this debt over the coming years. The ATO has issued about 7,000 director penalty notices (DPNs) this year and is issuing more at a rate of 300/ business day. The ATO has also recommenced filing wind up applications. The ATO has filed 35 wind up applications so far this financial year, already a significant increase on the 10 filed in all of FY 2020-21, but still a long way short of the 3,571 the ATO filed in FY2015-16.

This pressure will have a dual impact on insolvency appointments. First, direct pressure, as the ATO pushes businesses into an insolvency appointment following its debt collection activities; and secondly, as other creditors who have also withheld from firmer debt collections activities, now feel comfortable resuming firmer action following the ATO’s.

Inflation and interest rates

Inflation continues to be a problem, with the most recent result, for September, showing inflation running at 7.3% per annum and continuing to accelerate. Forecasts are for inflation to remain well above the RBA’s target range of 2.00% to 3.00% for two more years.

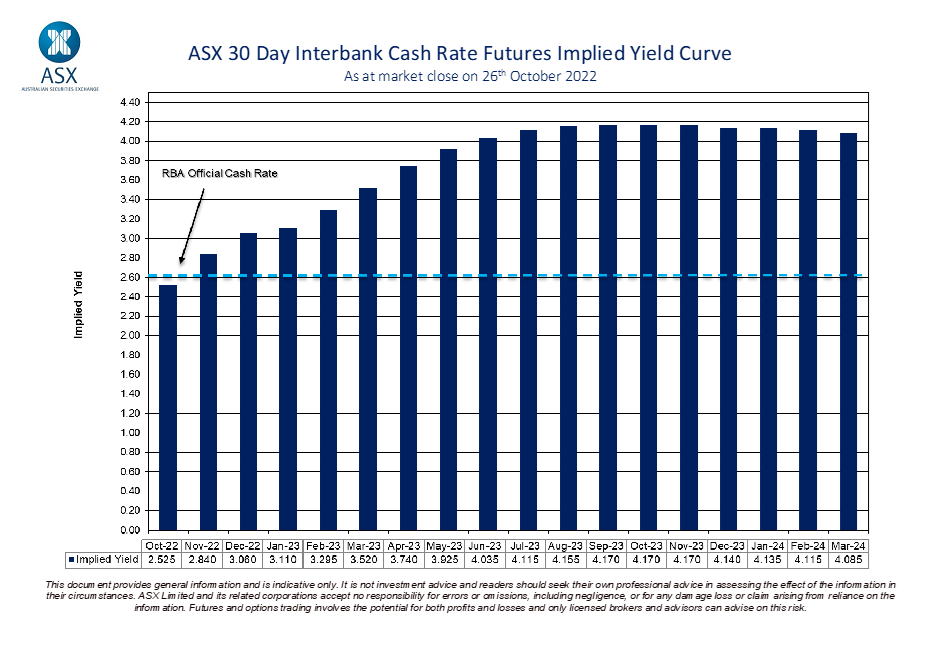

As a result, we will see interest rates continue to rise as the RBA takes action to bring inflation back down to the target range. Currently, the RBA’s cash rate is 2.60%. However, markets are implying we will see a peak rate for 4.20% in late 2023. This will place significant pressure on household budgets, which will flow through to business conditions.

Real wages are falling fast

The other downside risk for household spending, and thus the fundamentals underpinning the entire economy, is the rapid fall we are seeing in real wages. A combination of sluggish wage growth and high inflation has seen real wages fall to 2010 levels over the last 18 months.

This fall in real wages (especially if it continues) will eventually flow through to household spending and lead to a significant decline in business conditions, leading to more corporate and personal insolvency.

Recession?

The final factor that will lead to increased insolvency appointment numbers over the next two years is that our economy is very likely to slip into recession near the end of 2023 or in early 2024. The historical precedent is clear, periods of high excess inflation always require a recession to being broad-based inflation under control.

The global economy is slowing and likely going into recession in mid-2023 combined with domestic factors driven by a combination of households exhausting excess savings, declining real wages, and rising unemployment and interest rates will continue to put pressure on household budgets; leading to a decline in consumer spending and conditions for business, which will ultimately push our economy into a short recession.

While a recession will lead to higher insolvency appointment numbers, I do not expect to see levels as high as we saw during previous downturns.

It’s pretty clear that a downturn is coming, and the current positive trading conditions will allow many businesses to take steps to position themselves to better weather the storm, and I also expect the recession to be relatively short and shallow, meaning the impact will be limited.

[i] Australian Securities and investments Commission – insolvency Statistics (current) – Series 2 - https://asic.gov.au/regulatory-resources/find-a-document/statistics/insolvency-statistics/insolvency-statistics-current/

[ii] Australian Financial Security Authority - monthly personal insolvencies - https://www.afsa.gov.au/about-us/statistics/monthly-personal-insolvency-statistics

[iii] NAB Quarterly Business Survey - September 2022 - https://business.nab.com.au/nab-quarterly-business-survey-september-2022-56500/

[iv] ANZ Research - https://www.anz.com/institutional/our-expertise/anz-research/

[v] ASX - https://www.asx.com.au/data/trt/ib_expectation_curve_graph.pdf