Critically: bankruptcy shouldn’t be seen as a failure.

Last month, Australia saw its thirteenth consecutive interest rate rise leading to more pain for both mortgage holders and small businesses alike in trying to meet their regular loan repayments. While the number of people filing for bankruptcy is still at an historic low, it’s expected personal insolvency appointments will increase throughout 2024 as Australians deal with what seems to be ever increasing cost-of-living pressures.

Recently, bankruptcy enquiries have increased, and we’re frequently addressing several misconceptions about how bankruptcy works and what its implications may be.

Here are the five most common misconceptions.

1. A bankrupt…will lose all their assets.

Certain property is exempt from vesting in the bankruptcy trustee and therefore isn’t available to the creditors of the bankrupt estate. That property includes necessary household furniture, personal and sentimental property, tools of trade to an indexed limit and vehicles used as a means of transport to an indexed limit.

2. A bankrupt…will have their wage garnished to the extent that they have no money to live.

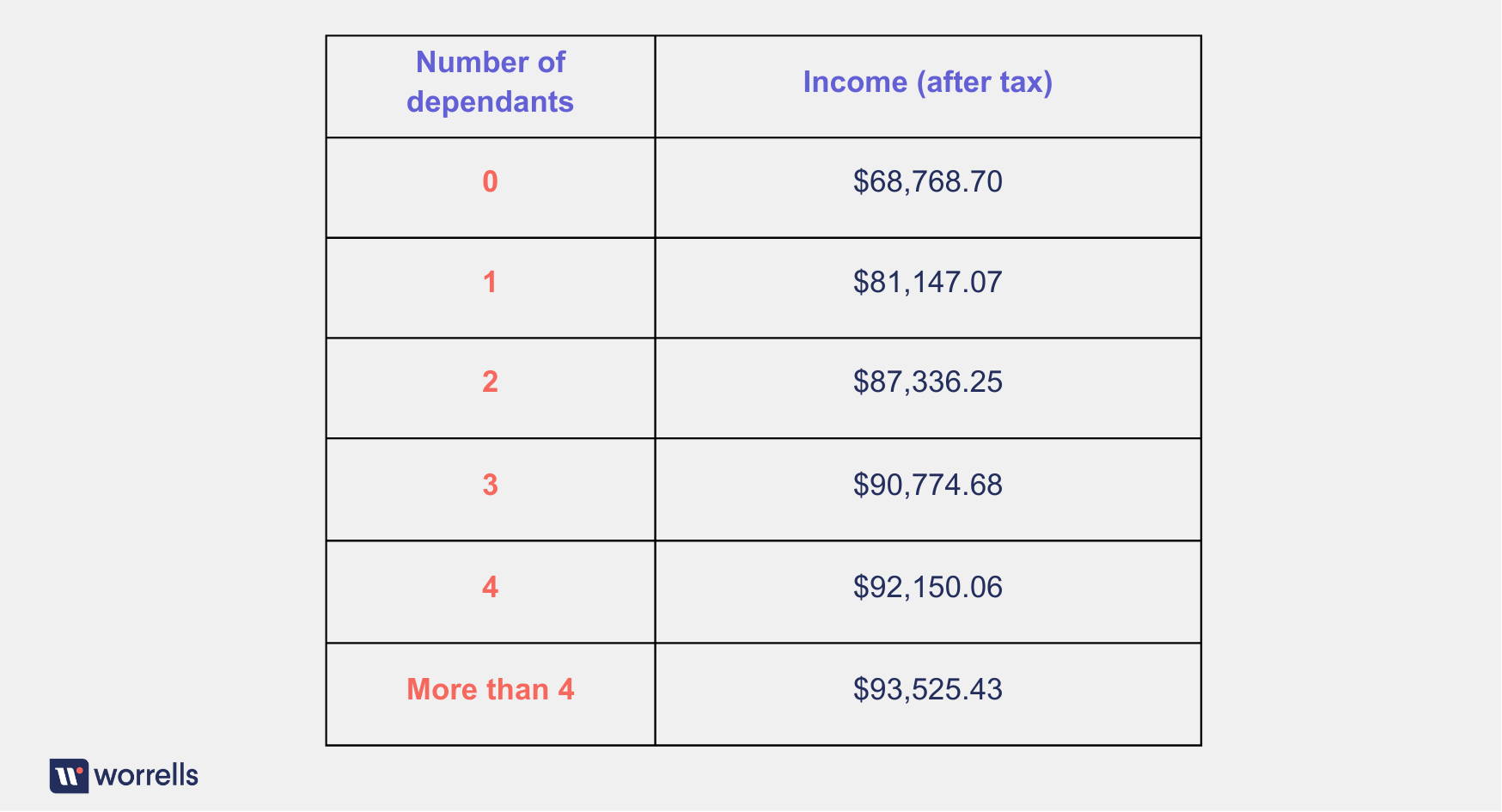

The Bankruptcy Act 1966 contains the compulsory income contribution scheme, which provides a statutory requirement for a bankrupt to pay money to their bankrupt estate if their income after tax exceeds an indexed income threshold. The current income thresholds are shown in the table below (the applicable threshold depends on how many dependants the bankrupt has and is subject to change due to indexation).

3. A bankrupt…can’t run a business.

A bankrupt can’t be a company director, but they can operate a business under their own name (if they choose to operate a business under a different name, they must disclose to everyone they trade with that they are an undischarged bankrupt).

4. A bankrupt…loses their creditworthiness for the rest of their life.

Typically details of the bankruptcy will remain recorded on an individual’s credit report either five years from the date the bankruptcy commences, or two years from when the bankruptcy ends. After that time, the individual can look to rebuild their credit score.

Details of the bankruptcy will also be noted on the National Personal Insolvency Index (NPII) which is a publicly available and permanent electronic record of personal insolvency proceedings in Australia.

5. A bankrupt…can’t travel overseas.

A bankrupt can travel overseas if they obtain written permission from their bankruptcy trustee before departing Australia.

However, the biggest misconception of all is that bankruptcy always represents failure.

Bankruptcy shouldn’t be seen as a failure. Unfortunately, not every business will work out and at times individuals will face challenges in meeting their personal debts. Australia’s insolvency laws are in place to assist people to get a fresh start and move on to other opportunities.

Australia must continue to foster entrepreneurial behavior and to encourage people to take measured risks to not only meet our future challenges, but also embrace the many opportunities on offer.

At Worrells, with 34 Principals across our 29 locations, we help individuals and businesses dealing with financial stress. Your local Worrells Principal is here to help (click here). Contact us for a complimentary and confidential discussion.