We’re in for a wild ride! And more insolvencies will be part of the price.

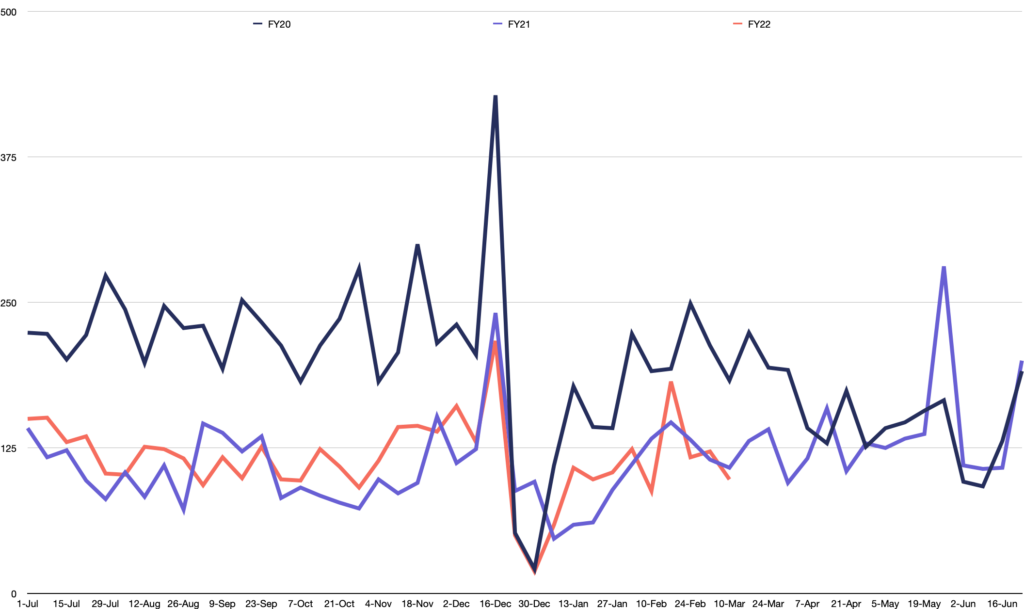

We all know the story by now, insolvencies have been down on the long-term average for two years now and so far, at least, we aren’t seeing much of an uptick. While the mood around the industry is that the tide is starting to turn, this isn’t being borne out in the hard numbers yet.

Corporate insolvency appointments for the year to date remain down approximately 35% on historical levels, exactly the same decrease we saw at the same time in 2021.

Source: ASIC – Series 1B Notification of companies entering external administration and controller appointments – weekly.

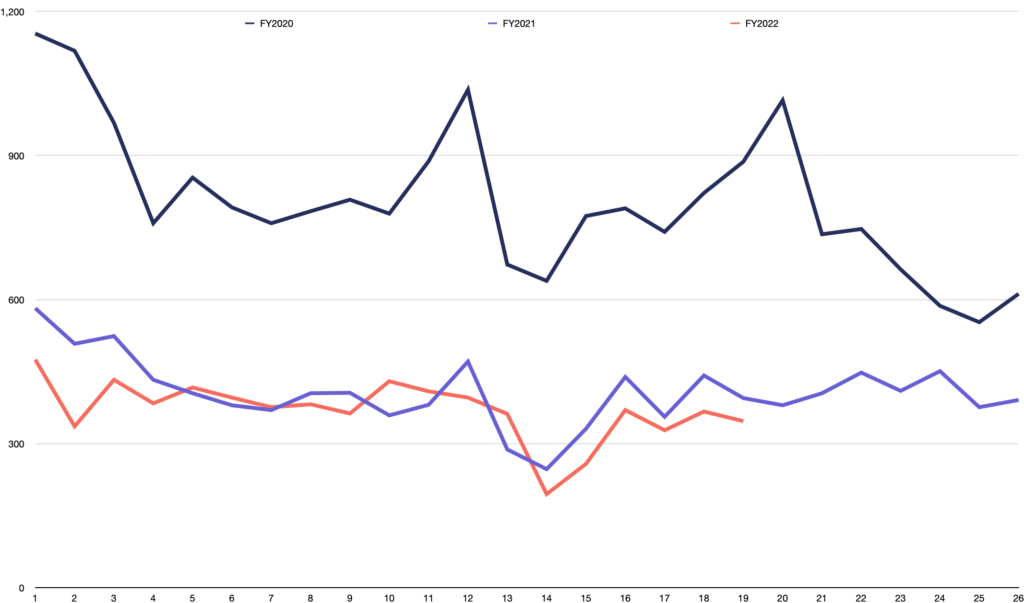

In the personal insolvency space, the story is the same, with the number of appointments slightly lower than 2021 and still less than 50% of the long-term average.

Source: AFSA's Provisional annual personal insolvency statistics 2020; 2021; 2022.

Despite actual appointments still being sluggish, the consensus across the industry is that enquiry levels have increased substantially in 2022 and the insolvency market looks to be moving back towards normal appointment volumes.

Let’s take a quick look at the major challenges businesses are likely to face over the rest of 2022 that will drive an increase in business failures.

The debt collection holiday is over

The Australian Taxation Office (ATO) historically was Australia’s most active creditor. The ATO filing winding-up applications against companies and issuing director penalty notices (DPNs) and statutory demands were a significant catalyst for both voluntary liquidations and companies restructuring.

When COVID-19 hit in early 2020, the ATO halted its debt recovery action. The ATO has now restarted its debt collection activities, addressing the backlog of tax debt accrued over the last two years but expects that it will take a couple of years to catch up. Therefore we expect to see ATO action resulting in more insolvency appointments than we’ve traditionally seen.

Other creditors who deferred debts in support of SMEs through the pandemic period are reverting to normal debt collection practices. In particular, we are starting to see landlords take steps to recover the rent deferred during the pandemic.

Uncertainty in supply chains

One of the other big factors causing businesses difficulty is the continuing uncertainty in supply chains. This has made it difficult for businesses to get the supplies needed to run their business and is more expensive when supplies can be obtained.

The rising costs of building materials was a key factor in the recent high-profile failure of both ProBuild and Condev. These supply chain issues will continue for some time, with the war in Ukraine and associated sanctions, China’s ongoing commitment to COVID-Zero, and structural issues in the global supply chain are expected to continue influencing supply chains beyond 2022.

Inflation and interest rates

Hand in hand with supply chain issues is inflation increasing, forecasted at 4.9% over the next two years. This will put pressure on business through rising costs and wage increases that will flow from that.

Also expected is the Reserve Bank of Australia raising interest rates this year, with rates likely to rapidly return to more ‘normal’ levels around 2% in the next 12 to 18 months. This will add pressure by increasing business’s debt servicing costs, while also reducing disposable income that consumers have to spend.

Australians have very high levels of household debt, meaning the impact of interest rate rises on disposable income is significant. A 2% increase in interest rates would result in a 10% reduction in household disposable income meaning they have less money to spend in local businesses.

What this means for insolvency appointments

In short, both corporate and personal insolvency appointments will increase. We expect to see insolvencies pick up after the May election and to peak at well above historical levels in early- to mid-2022 as the combined impact of more difficult business conditions, less accommodating creditors, and the hangover from pandemic trading conditions combine to produce a uniquely and profoundly difficult environment for SMEs.

.png?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)